Roble Belko & Company

Roble Belko & Company is an investment advisory firm located in Pittsburgh, PA offering wealth and risk management services for high net worth individuals, families, and small institutions. We believe in the fundamental principle that investment diversification leads to capital preservation over the long run. Our investment strategies cater best to clients who want to preserve and enhance their assets through a holistic approach and seek to cultivate deep relationships with their advisors.

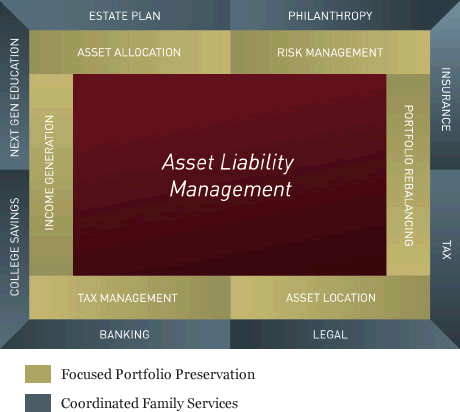

Whether for a family or institution, our disciplined process is centered on an asset-liability management framework to provide long run solutions toward their objectives. This approach relies on a proprietary risk management system developed as a result of several decades of capital markets experience. For families we further overlay a coordinated service offering to drive a transparent and integrated wealth management platform across various important aspects of their lives.

Our Holistic Service Offering

People

Our Principals have over sixty years of combined experience in the investment industry. Our Team is homegrown and also comes predominantly from prior careers in the institutional markets. They have worked their way toward advanced degrees and certifications such that they are best prepared to add value for our clients. This is important, since we believe very much in a team oriented approach to our client service delivery model.

Process

We have developed an investment process well suited for institutional clientele, however we utilize the same disciplined process for our family clients. Given our fiduciary obligation to our clients, we’ve incorporated many different risk management tools into our process. Investment decisions are driven via a healthy combination of quantitative and qualitative analysis, some of which can be attributed to our years of experience in the investment industry.

Technology

We have custom built the key systems we use for our investment process, including our proprietary risk management system and our investment model. In our desire to be as transparent as possible, we have customized a financial dashboard with daily feeds of various investment metrics we utilize as advisors and portfolio managers. This technology has further enhanced the client experience, while creating greater efficiencies in the delivery of information and service.

Our Clients

Families

Family. Assets. Lifestyle. Legacy.

Roble Belko & Company serves as a financial advisor to a select group of entrepreneurs, business owners and executives who, with limited exceptions, have a minimum of $3 million in investable assets. Our clients are typically, but not always, first generation wealth creators who desire a diversified and disciplined investment approach seeking superior results over the long run. By working with a controlled number of clients, we are able to provide a holistic service offering which emphasizes an integrated wealth management approach for the whole family.

Institutions

Roble, Belko & Company also works with small institutions that otherwise cannot get the attention of the larger service providers. These mandates span from traditional asset allocation strategies to more sophisticated asset/liability management and cash matching strategies. Again, by working with a select number of mandates, we can provide these clients a level of service they deserve.

Our Services

Families

Asset/Liability Management

- Retirement Planning

- Risk Management

- Asset Allocation

- Income Generation

- Tax Management

- Asset Location

- Portfolio Rebalancing

Coordinated Family Services

- Next Gen Education

- Estate Plan

- Tax

- Insurance

- College Savings

- Banking

- Legal

- Philanthropy

Institutions

Asset Management

- Custom solutions to better align assets with program funding needs

- Combined multi-decade capital market experience

- Independent manager evaluation and oversight

Risk Management

- Ongoing monitoring and oversight through a proprietary risk model

- Scenario testing and modeling to manage risks and support financial decisions

Our Technology

View a customized Client Dashboard from any device

- View net worth snap shots at the click of a button

- Access up-to-date investment and portfolio summaries

- Organize and archive important financial documents

WHY US

We serve as a financial advisor to a select number of clients

We provide our clients independent, objective advice from an open architecture platform

We offer direct access to the principals and decision makers of our firm

We work with our clients’ other trusted professionals (tax, accounting and legal) to create an investment strategy that is tax and risk optimized

We are committed to providing a transparent wealth management service, which includes educating our clients on every aspect of their wealth plan

We developed a proprietary risk management system and offer a personalized financial dashboard

Our principals together have over six decades of institutional and private client investment experience in the equity, fixed income and alternative investment markets

What is Preservation?

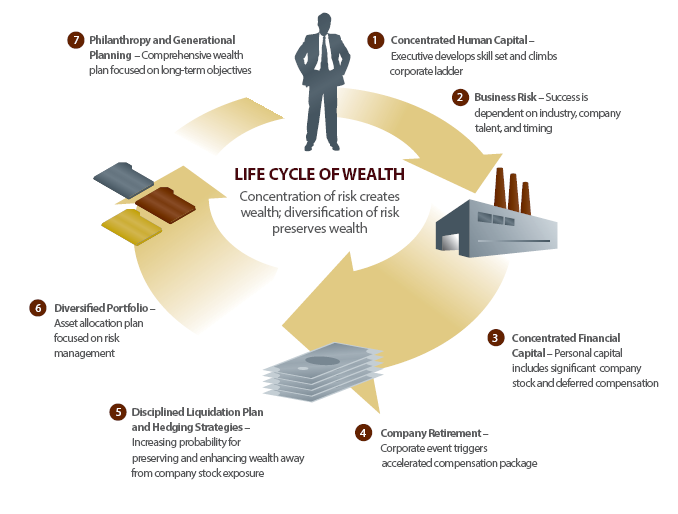

To us, preservation means ultimate protection – safeguarding a lifetime of investments, decisions, propositions and dreams. We often find that the concentration of risk is what creates the wealth, while the diversification preserves it. By providing our clients with a disciplined wealth management style, we never stray from the ultimate goal of wealth preservation.

Risk Management

Often times our clients have successfully passed the riskier stages of their business ventures, and have had the good fortune of a liquidity event. As their financial advisor, we provide our clients an appropriate game plan and tools to navigate investment risk and a plan that seeks to satisfy their retirement and philanthropic objectives.

Our Team

Roger W. Roble

President

Roger Roble is the President of Roble Belko & Company. Roger founded the firm in 2000 with the goal of providing independent, objective advice to a select group of high net worth and institutional clients. Roger’s responsibilities include relationship management, strategic planning and business development. His extensive background in the institutional public finance markets has helped in the implementation and trading of customized municipal bond portfolios for our high net worth clients. Roger is also very involved in the coordination of our wealth management services with our clients’ tax and legal advisors.

Roger received his M.B.A. degree from Carnegie Mellon University in 1986, following undergraduate studies at CMU that earned him Academic All-American Football honors in 1985. He began his career with CS First Boston in New York, subsequently working in Institutional Fixed Income Sales in CS First Boston’s Philadelphia and Chicago offices. Roger then spent 5 years in A.G. Edwards’ Chicago office, focusing primarily on the tax exempt bond market. During his 14 years of institutional coverage, Roger traded various fixed income securities to mutual funds, bank trusts, insurance companies, corporations, and investment advisers.

Roger currently is a member of the Independent Review Committee of Vanguard Investments Canada and also serves as Vice Chairman of the St. Anthony School Programs Board.

William Belko, CFA, CFP®

Chief Investment Officer

Bill Belko is the Chief Investment Officer of Roble Belko & Company. Bill joined the firm in 2002 and is currently responsible for portfolio management, investment research and trading. Bill oversees the firm’s investment process and developed the firm’s proprietary risk management system . His quantitative background in equities and derivatives has helped in the risk management and liquidation of single stock exposure and portfolio hedging for several of our clients. Bill has also developed an asset/liability management system, which analyzes interest rate risk for appropriate client mandates.

Bill graduated Summa Cum Laude from California University of Pennsylvania and attained Academic All-American honors in basketball in 1984. He then received his M.B.A. degree from Carnegie Mellon University in 1986 and became a Chartered Financial Analyst in 1991 and a CERTIFIED FINANCIAL PLANNER™ in 2019.

Bill began his career with Dean Witter Reynolds in New York, working in Corporate Bond Trading and Institutional Fixed Income. He later joined Advanced Investment Management in 1989, where he helped pioneer the firm’s enhanced index arbitrage strategy. Bill eventually became a senior portfolio manager, managing over $6 billion in fixed income securities, equity derivatives, common stocks and exchange-traded funds for larger institutional pension and endowment funds. Bill currently is an adjunct professor at La Roche University and he also serves on the board of the Carnegie Museum of Natural History.

Ryan P. Lacey, CFP®

Relationship Manager

Ryan’s primary responsibilities include multi-generational financial planning and relationship management. He graduated from Edinboro University with a BBA in Financial Services and a minor in Economics. He also earned his MBA in Finance from Waynesburg University and his CERTIFIED FINANCIAL PLANNER™ designation. Ryan began his career at PNC Bank in Pittsburgh, working as a Licensed Financial Sales Consultant. His role included sales and service for all investment and bank related products. He then transitioned into the Private Client Group as a Relationship Manager, where he was responsible for providing dedicated services to high net worth clients.

Colleen E. Doughty

Chief Compliance Officer

Colleen’s primary responsibilities include oversight of compliance, operations and client reporting. She graduated from Ohio University with a BBA in Finance and a MBA with a concentration in Marketing from Duquesne University. Colleen began her career at BNY Mellon in Pittsburgh as a Managed Account Specialist. She then transitioned to Mellon Capital Management as a Senior Client Operations Accountant, where she was responsible for providing institutional clients and investment managers with timely and accurate reporting. Colleen is a member of the Greater Pittsburgh Compliance Roundtable.

Keith J. Wander, CFA

Portfolio Manager

Keith’s primary responsibilities include portfolio management, investment analysis, and trading. He graduated from Ohio University with a BBA in Finance and Business Pre-Law. He became a Chartered Financial Analyst (CFA) in 2011 and is a member of the CFA Society of Pittsburgh. Keith began his career with Northern Trust in Chicago, working in the Investment Risk and Analytical Services division. Keith later joined BNY Mellon Asset Management as a Senior Investment Analyst where his primary responsibility was performing independent and comprehensive investment manager due diligence across traditional and alternative asset classes.

Mario Posteraro, CFP®, CIMA®

Wealth Advisor

Mario’s primary responsibilities include multi-generational financial planning and relationship management. He graduated from Grove City College with a BS in Finance and earned an Executive Certificate in Financial Planning from Duquesne University. Mario is a CERTIFIED FINANCIAL PLANNER™ professional and Certified Investment Management Analyst®. He began his career with Teach For America in Cleveland working as a Math Teacher. Mario later joined PNC Wealth Management where he was an Investment Advisor & AVP, and provided portfolio and relationship management to high net worth clients. He is a member of the Financial Planning Association (FPA) of Pittsburgh and serves as the VP for the Young Professionals Advisory Committee (YPAC) for the Extra Mile Education Foundation.

.

Nicholas Cavanaugh

Investment Analyst

Nic’s primary responsibilities include portfolio management, investment analysis, and trading. He graduated from the University of Pittsburgh with a BBA in Finance. Nic began his career with Vicus Capital in State College, working as a Junior Portfolio Analyst. He later joined Hirtle Callaghan, & Co. as a Senior Analyst where his primary responsibility was conducting due diligence on private credit and long-only public equity managers.

Lillian L. Bowser

Operations Analyst

Lily's primary responsibilities include client reporting and operations. She graduated from Grove City College with a BS in Business Economics. Lily interned at Hefren-Tillotson her senior year and after graduation, she began her career at Ameriprise Financial as a Client Servicing Specialist, where her primary duties were preparing client meeting agendas and financial plans.

Kristen A. Barnes

Office Manager

Kristen’s primary responsibilities include accounts payable, accounts receivable and payroll. She graduated from Sawyer Business School with an AD in Specialized Business with a concentration in Clinical Administration. Prior to joining Roble Belko & Company, she spent several years in the medical industry.

Let’s start the conversation…

1603 Carmody Court, Suite 401

Sewickley, PA 15143

tel: 724.935.4990

fax: 724.935.4999